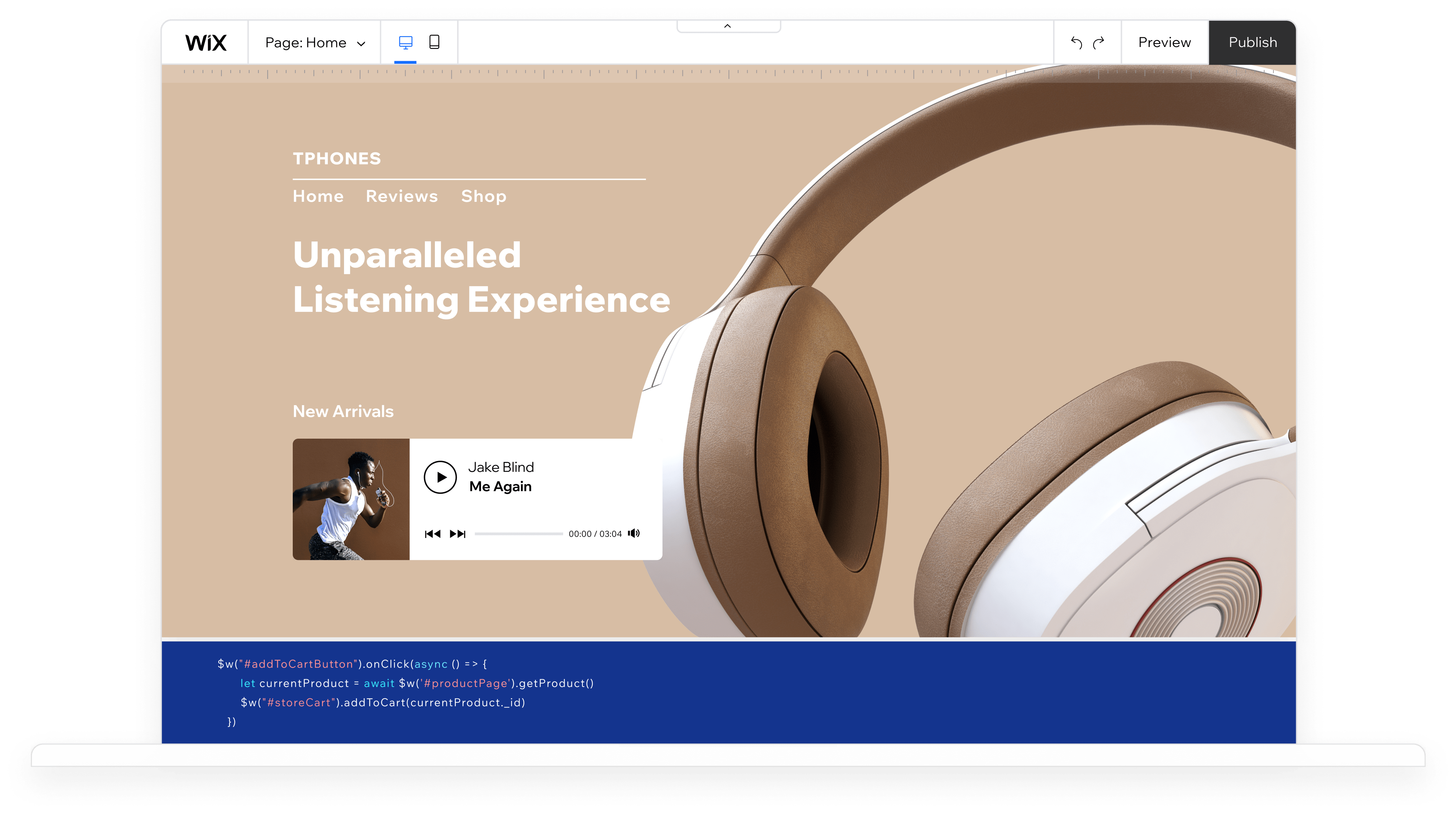

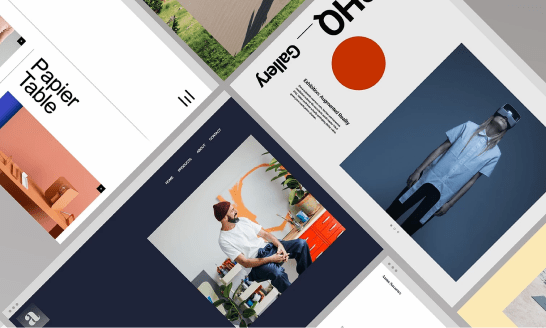

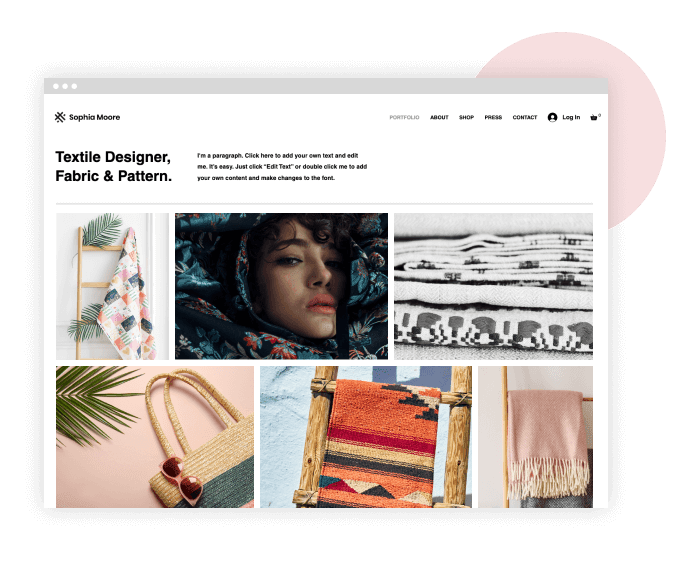

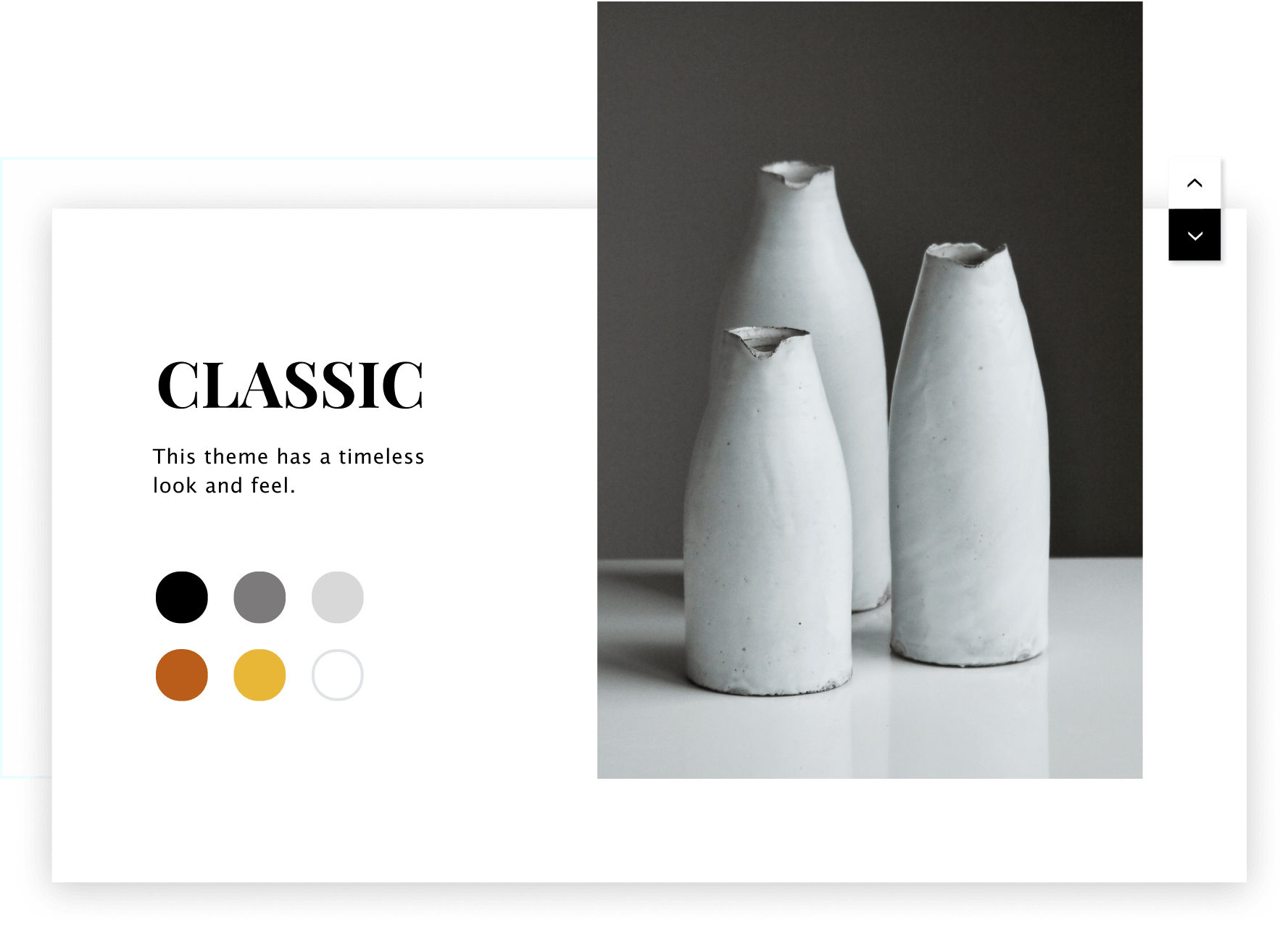

The freedom to create the websites you want

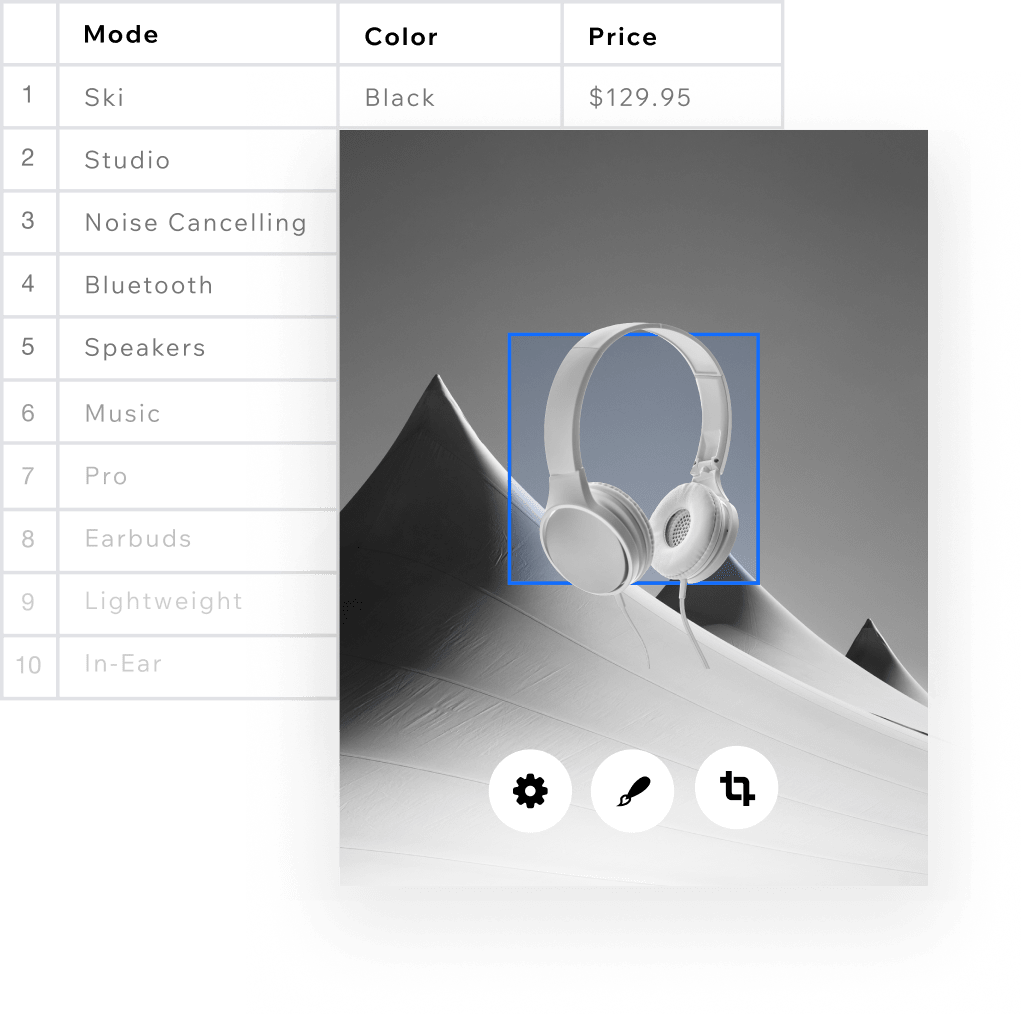

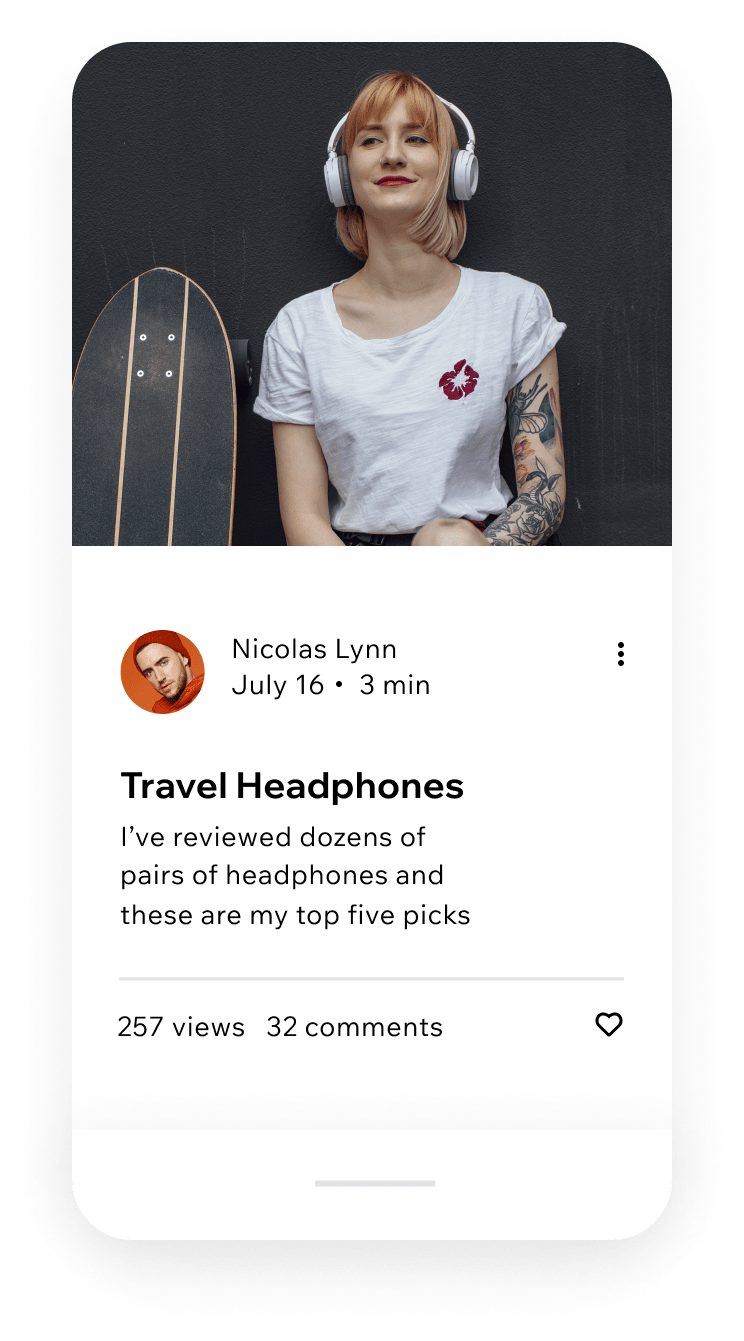

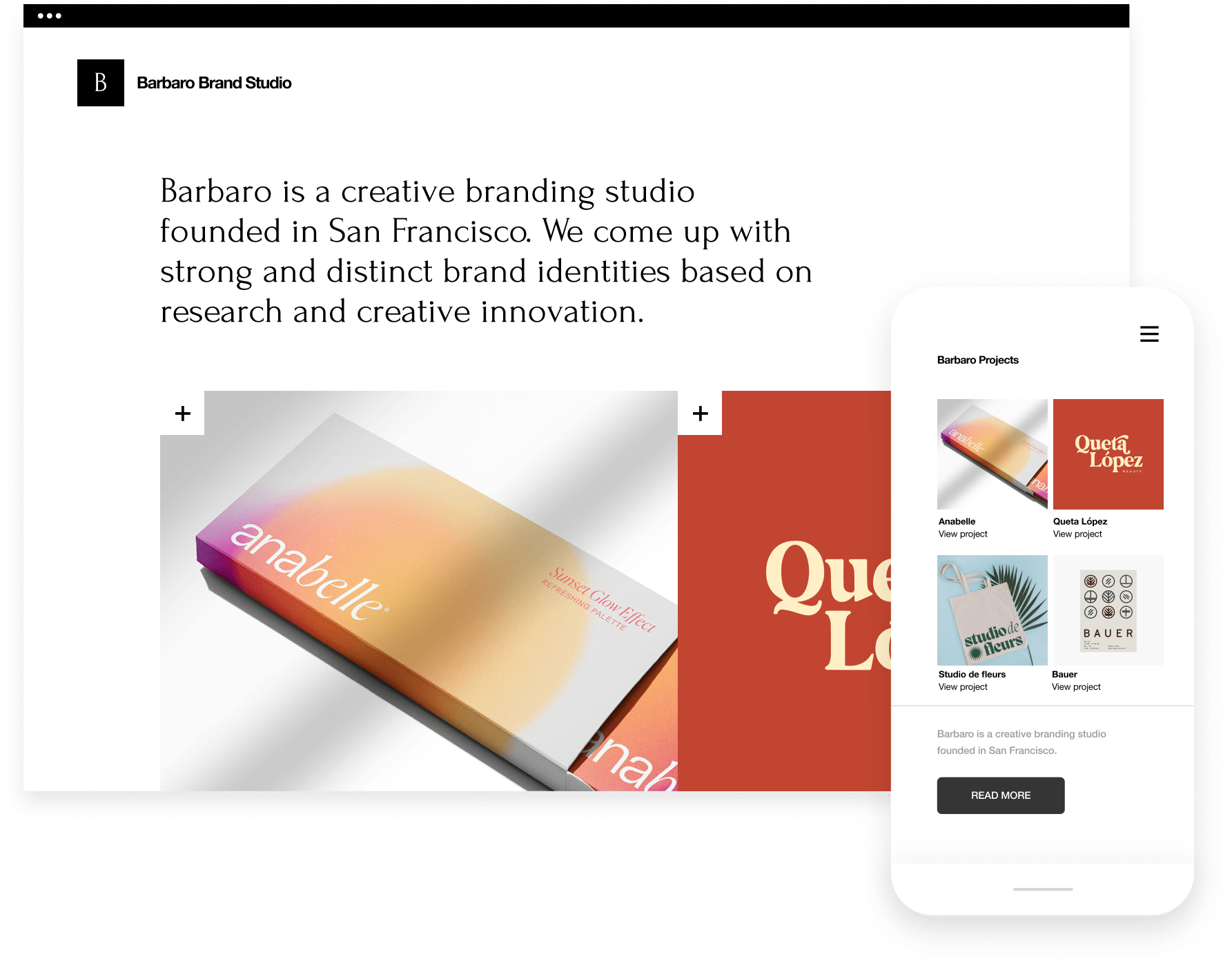

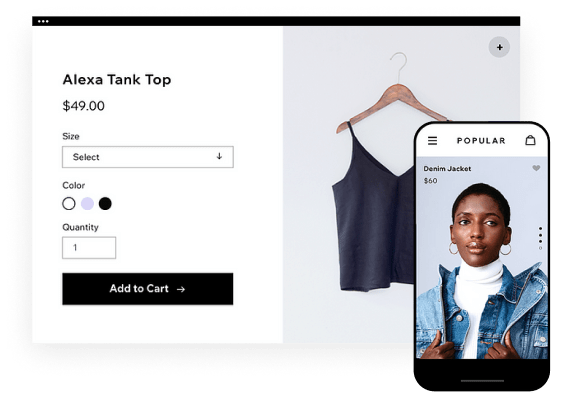

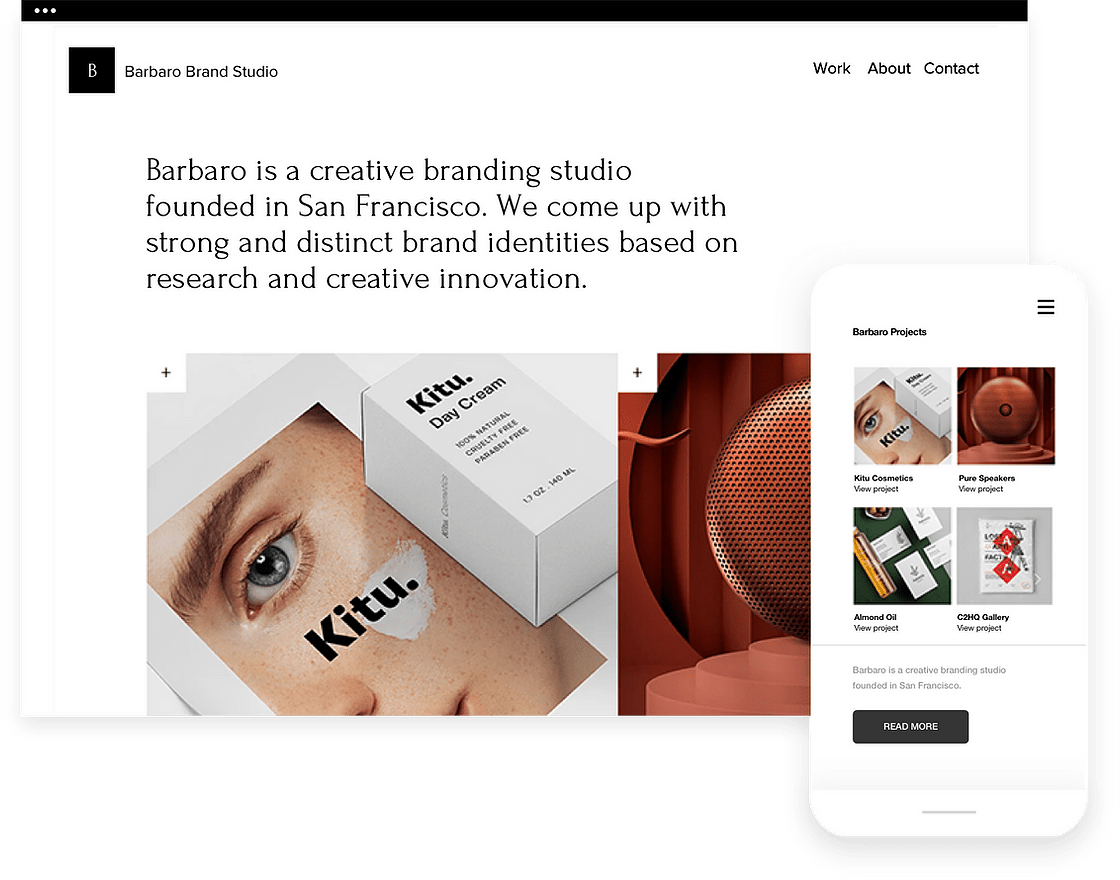

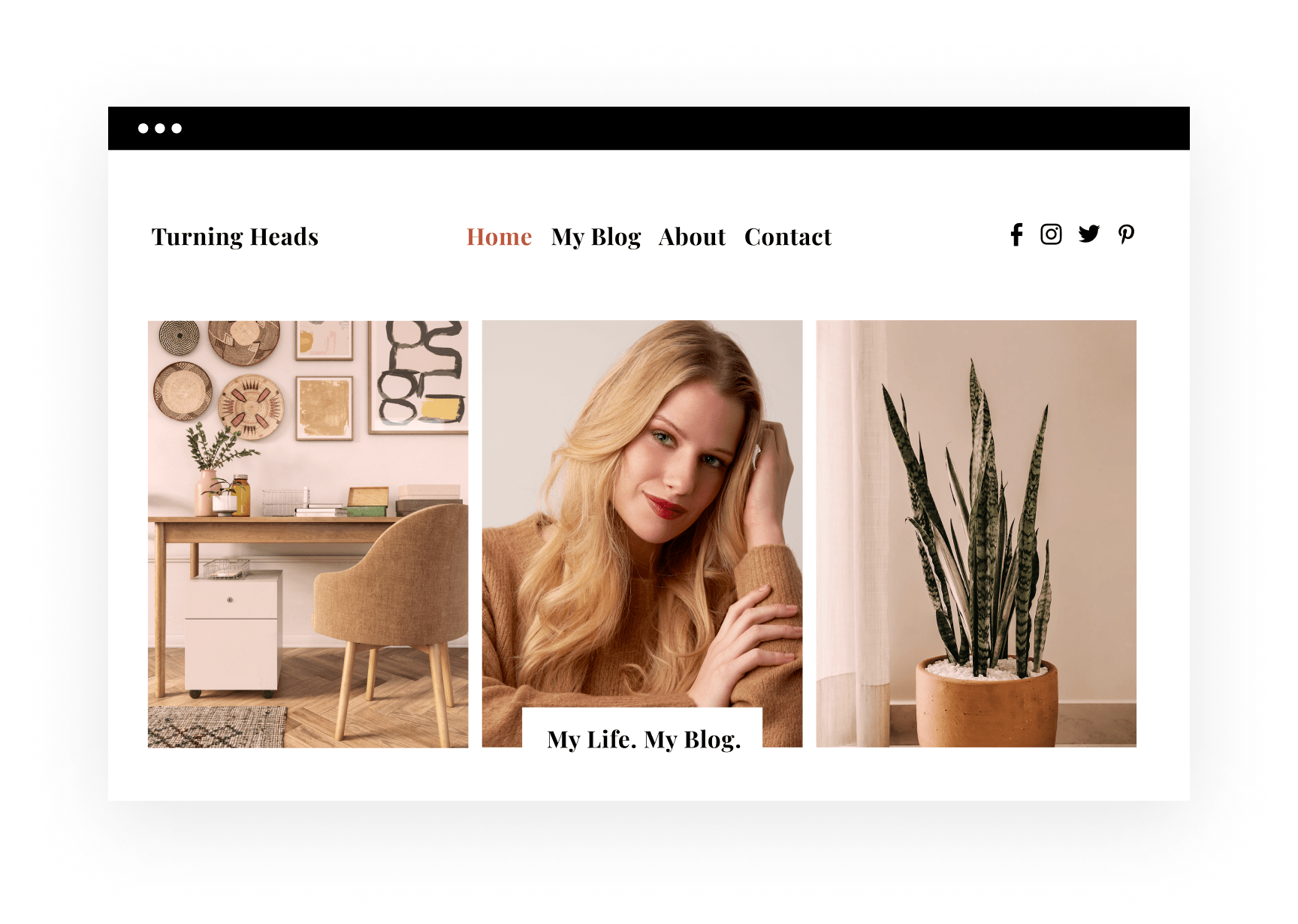

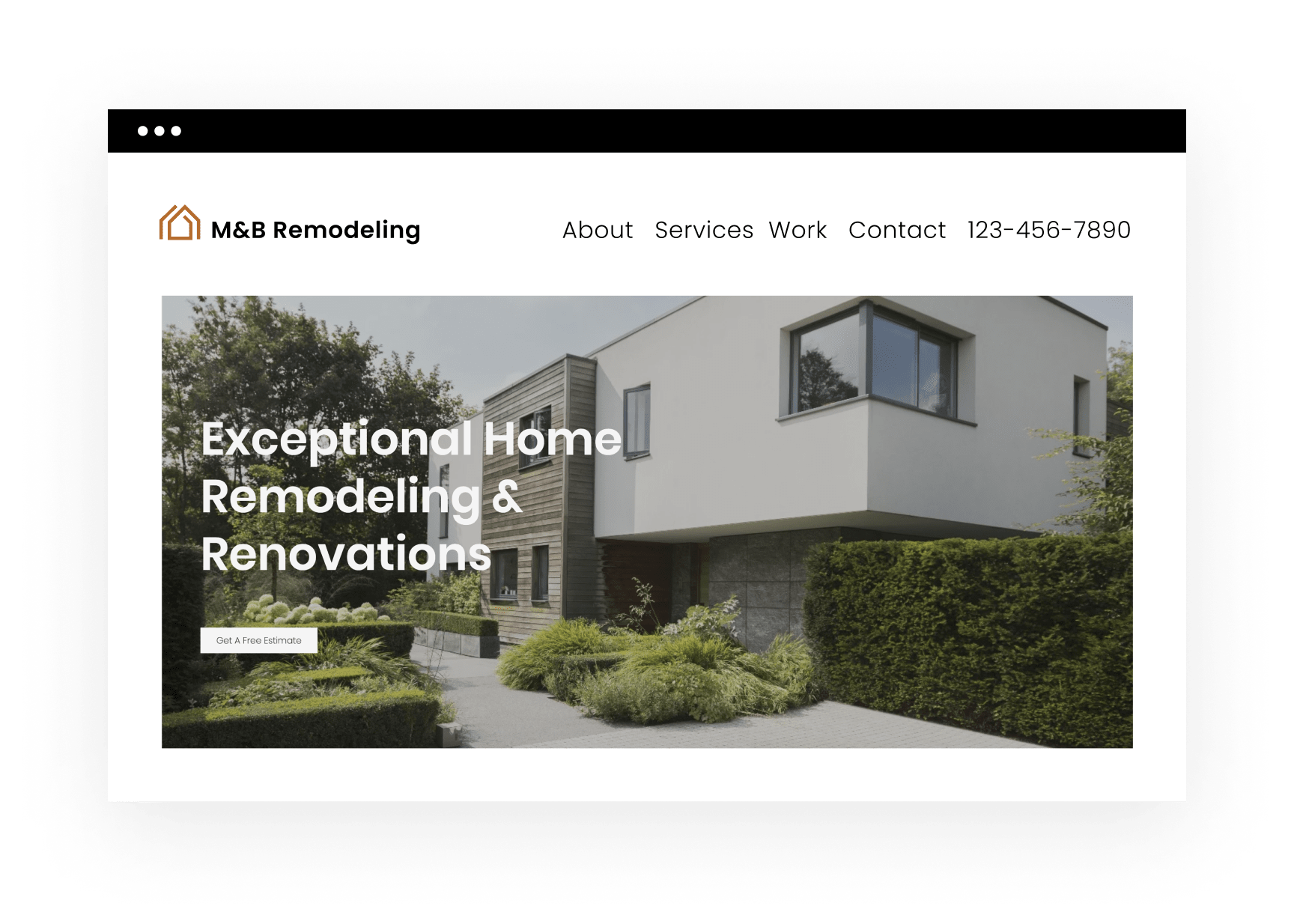

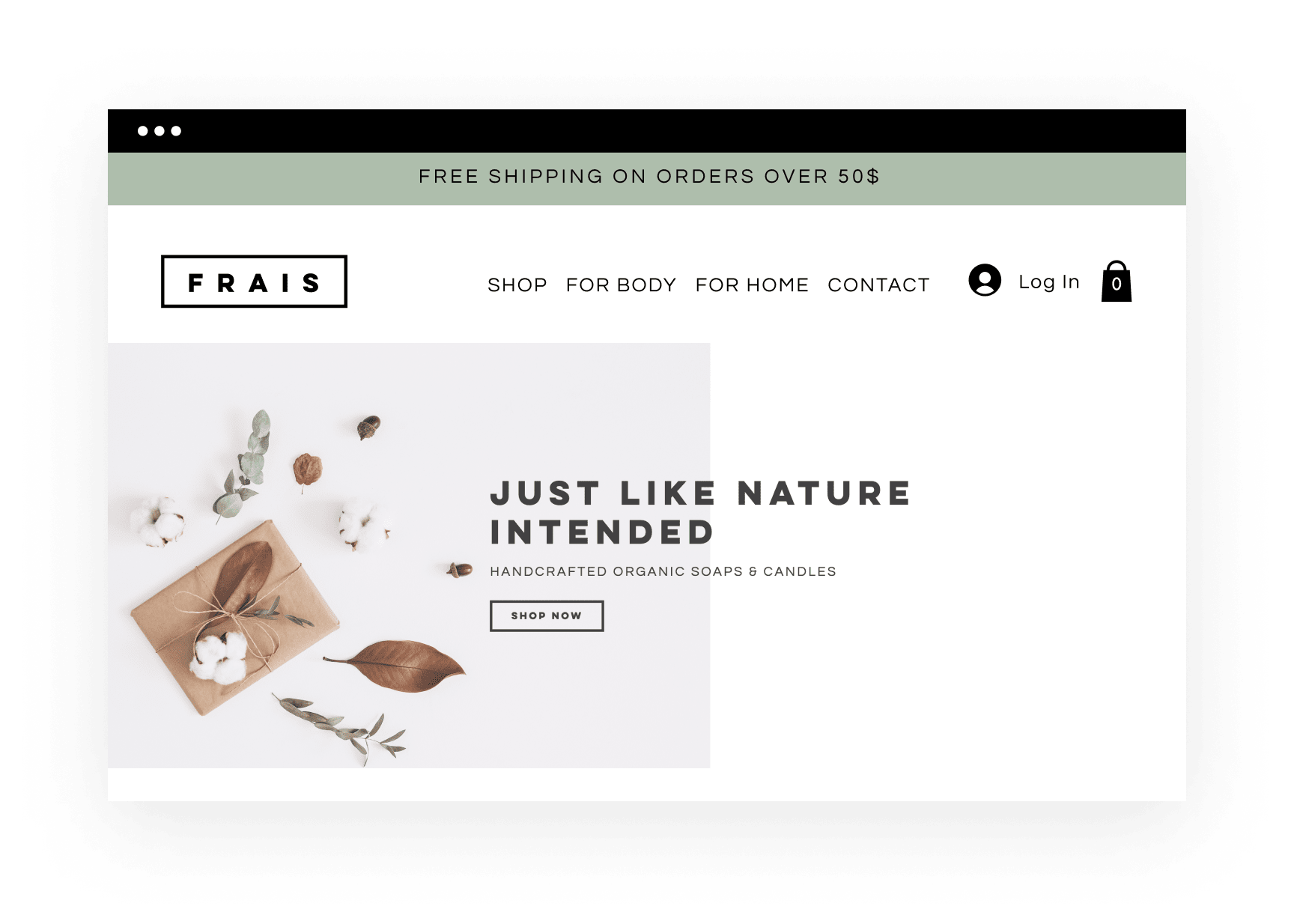

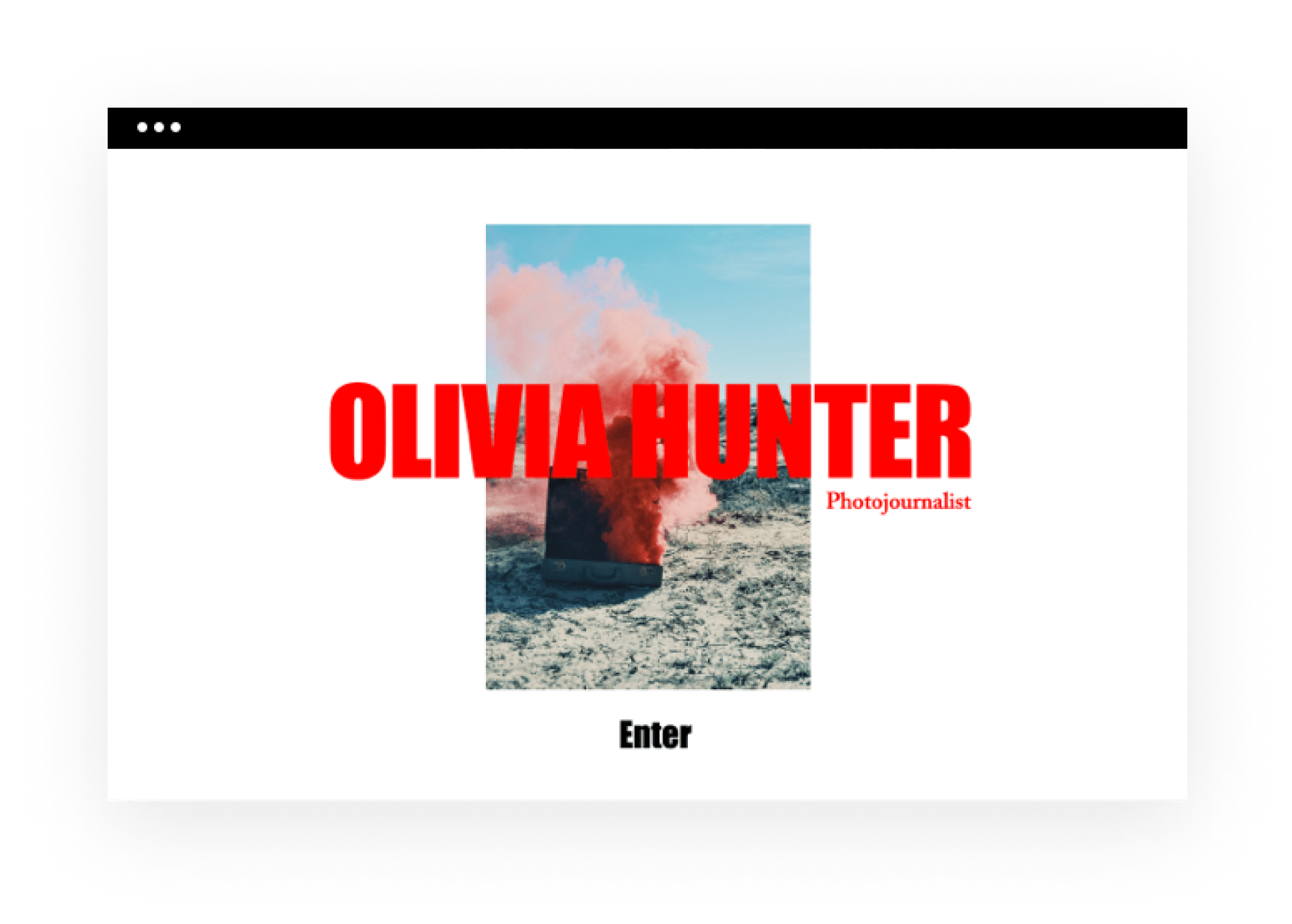

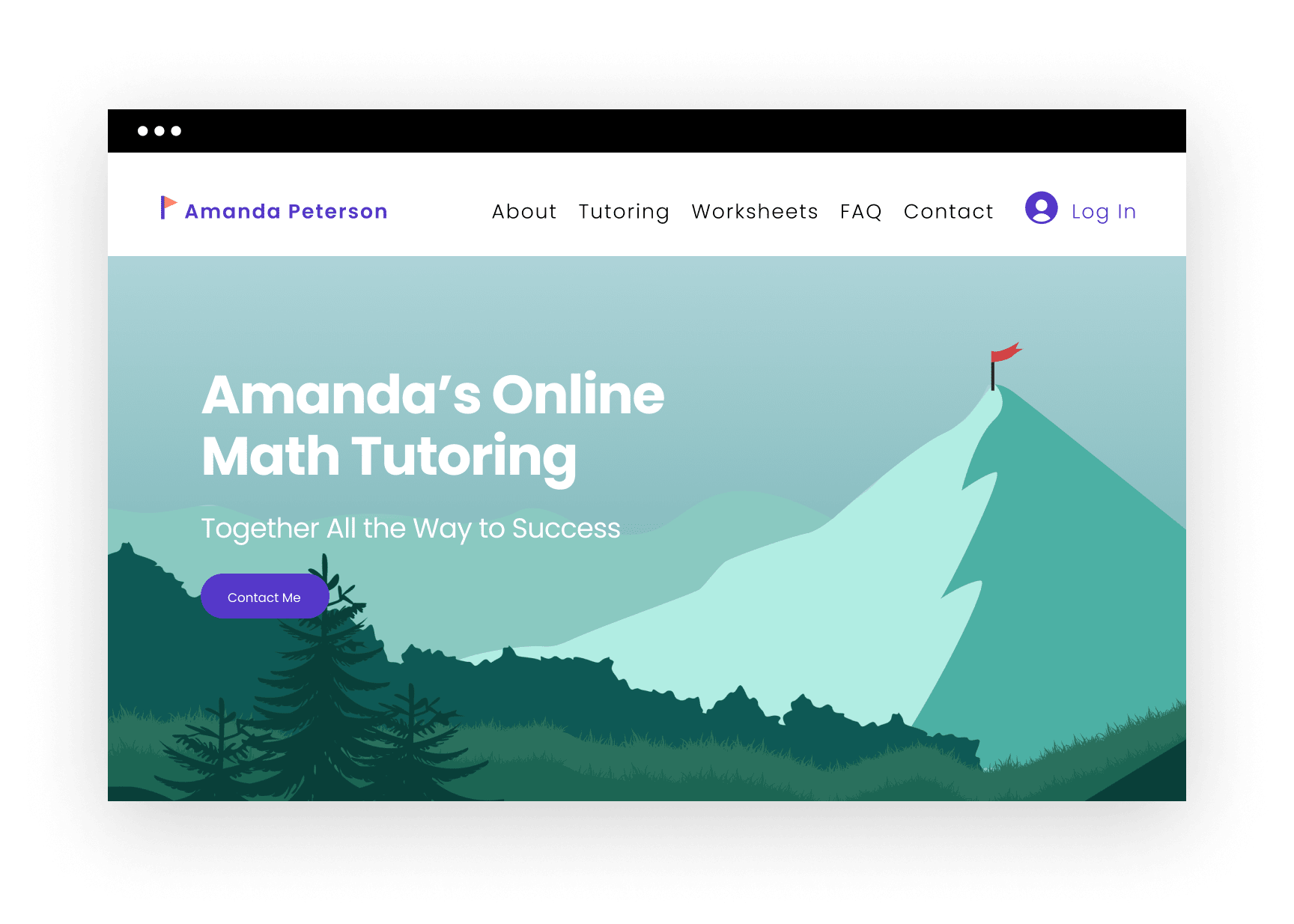

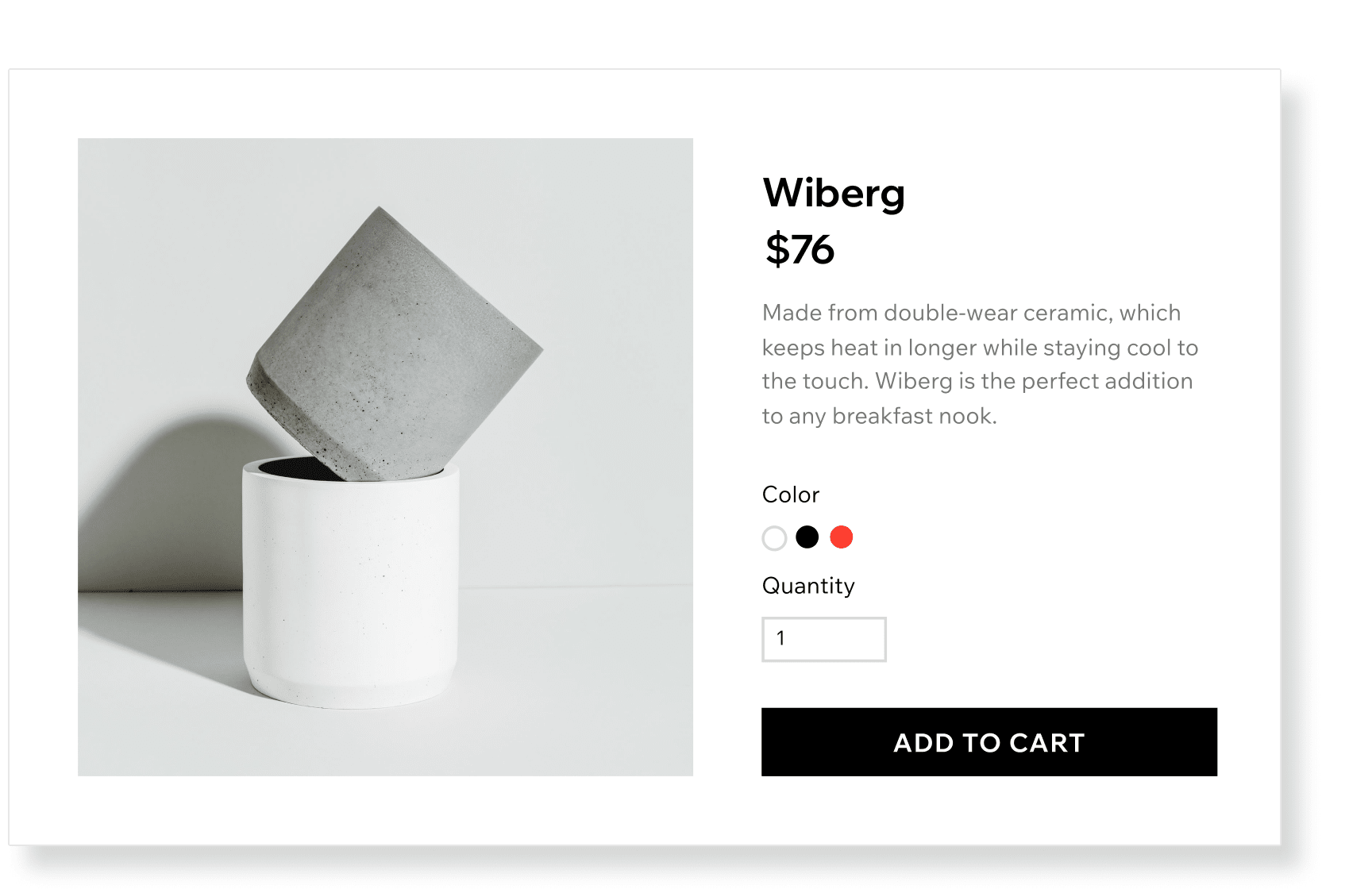

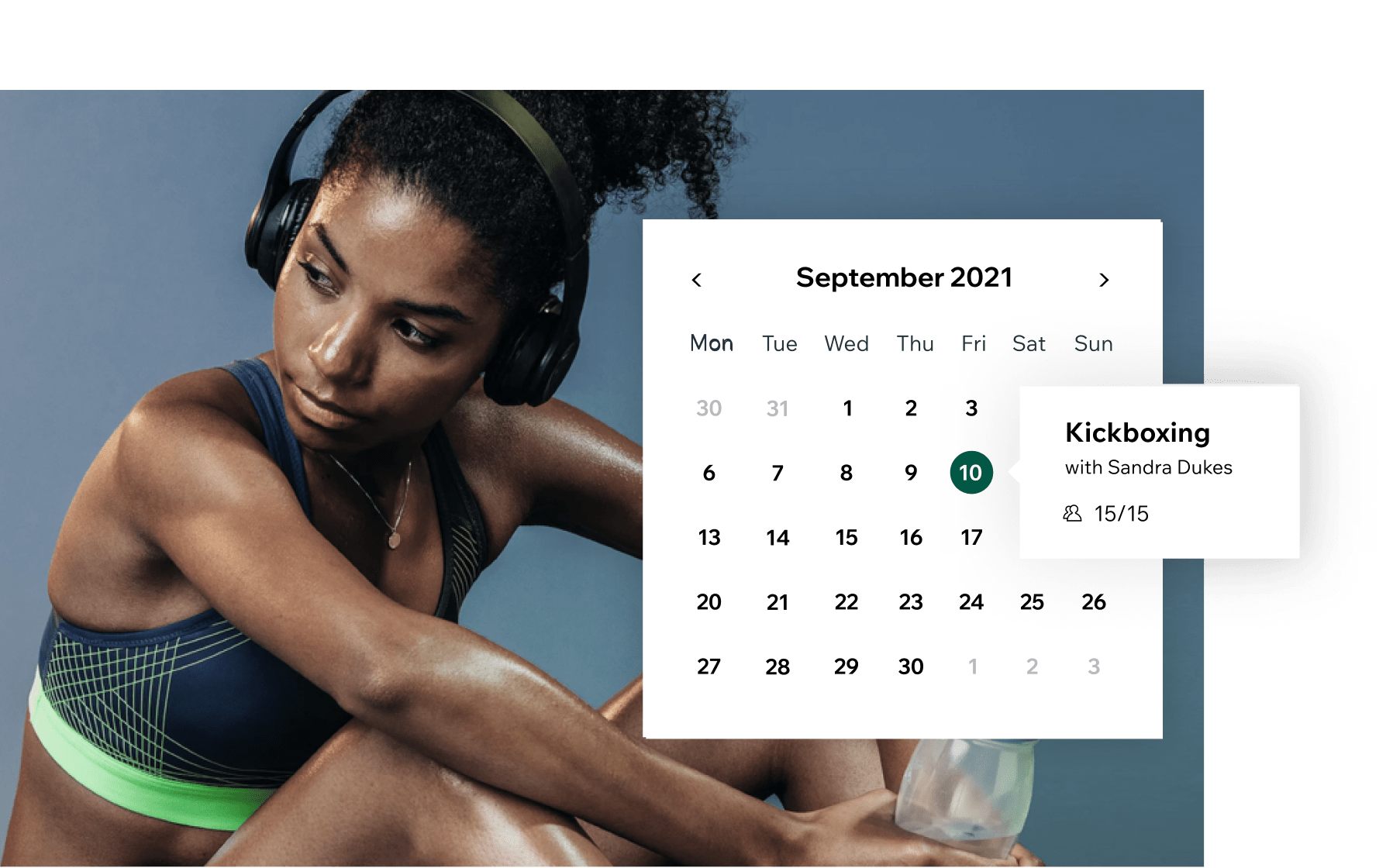

You can build your own website, no design expertise or design team needed. Whether you’re promoting your small business, showcasing your work, opening your shop or starting a blog – Wix’s free website builder makes it all possible.